Introducing MAX — Take supply chain cyber risk management to the MAX

Underwriters & Portfolio Managers grow profitable cybersecurity business lines with SecurityScorecard

Evaluate and reduce cyber risk with the industry’s most comprehensive continuous underwriting platform.

Make the shift to continuous underwriting

Traditional insurance practices don’t work for cyber risk because they rely on single-point-in-time assessments. These put insurers in a reactive state as they wait for claims to let them know that a change in strategy is needed. Leading insurers are shifting to a continuous underwriting approach that can keep up with a dynamic risk landscape. These insurers are growing, staying profitable, and satisfying customers using SecurityScorecard’s unique ability to quantify risks, increase resilience, and respond to incidents.

A View Inside

Reduce your exposure and drive your cyber insurance business to new heights

Build a Viable Cyber Line of Business

- Grow insurance premiums: Increase your book of business without sacrificing the due diligence needed to write profitable risks.

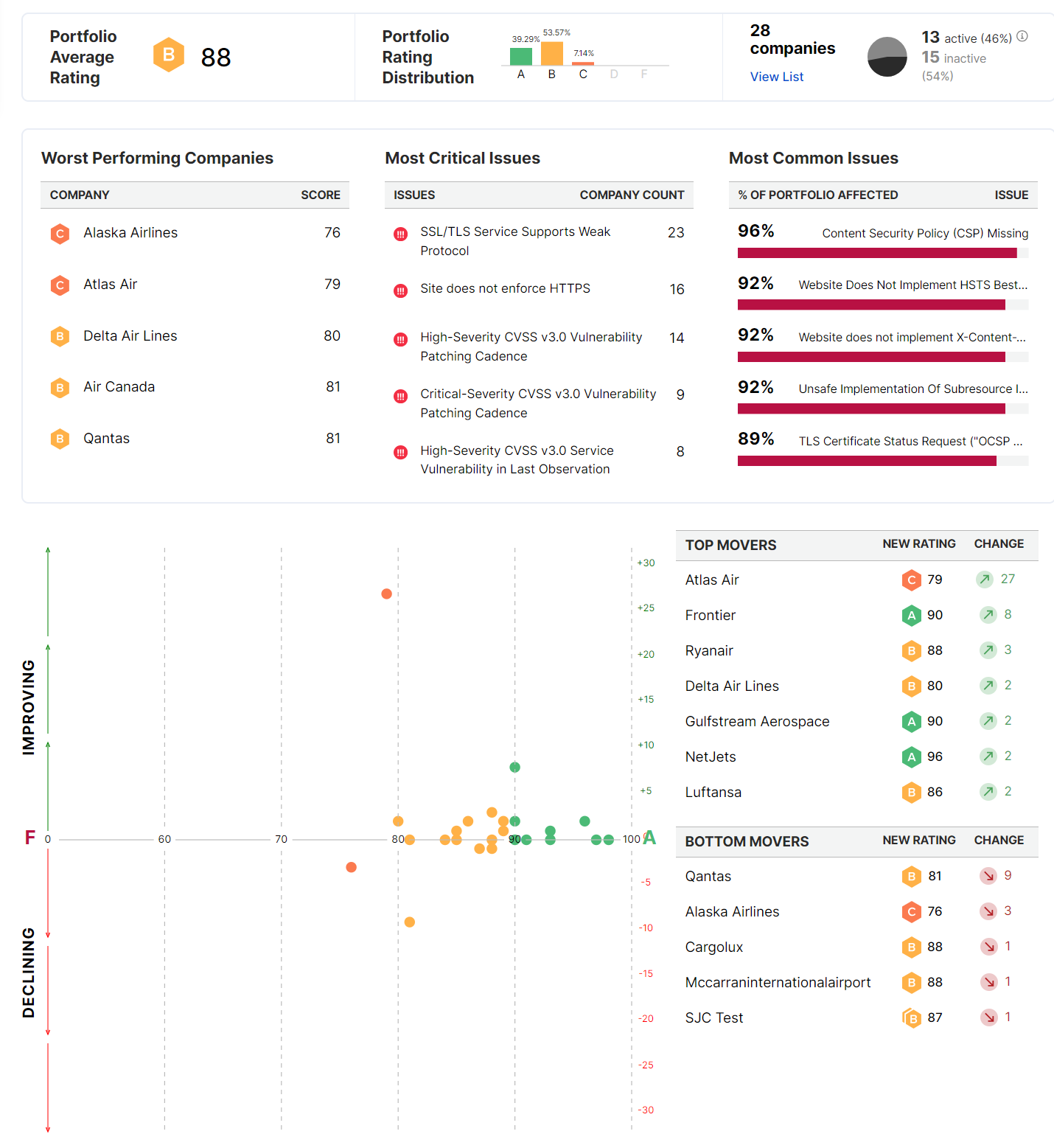

- Manage loss ratios: Prevent security incidents and claims with targeted risk mitigation strategies.

- Improve policyholder retention: Keep highly satisfied, engaged, and insurable policyholders.

Critical Capabilities

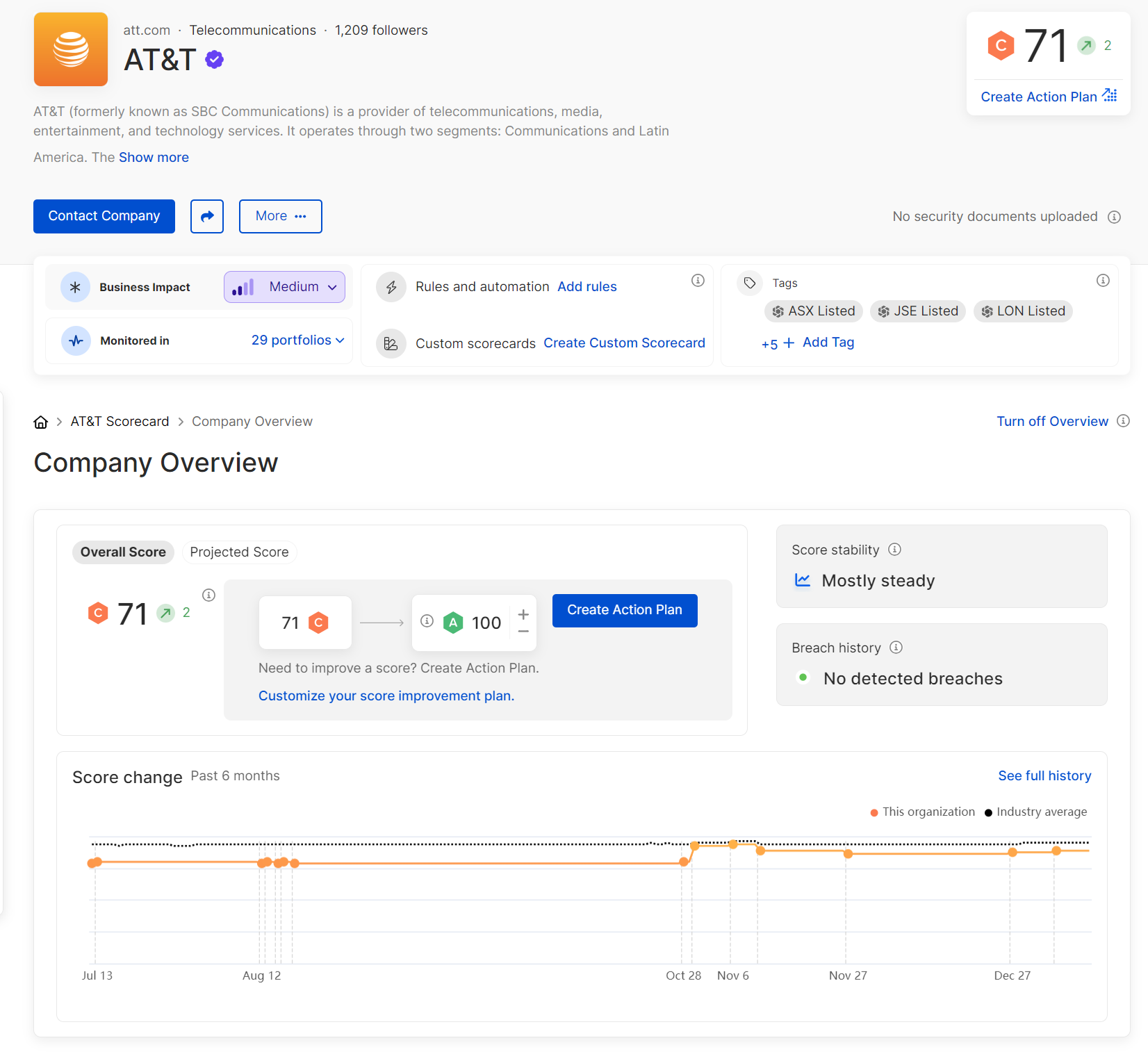

Non-intrusive scanning

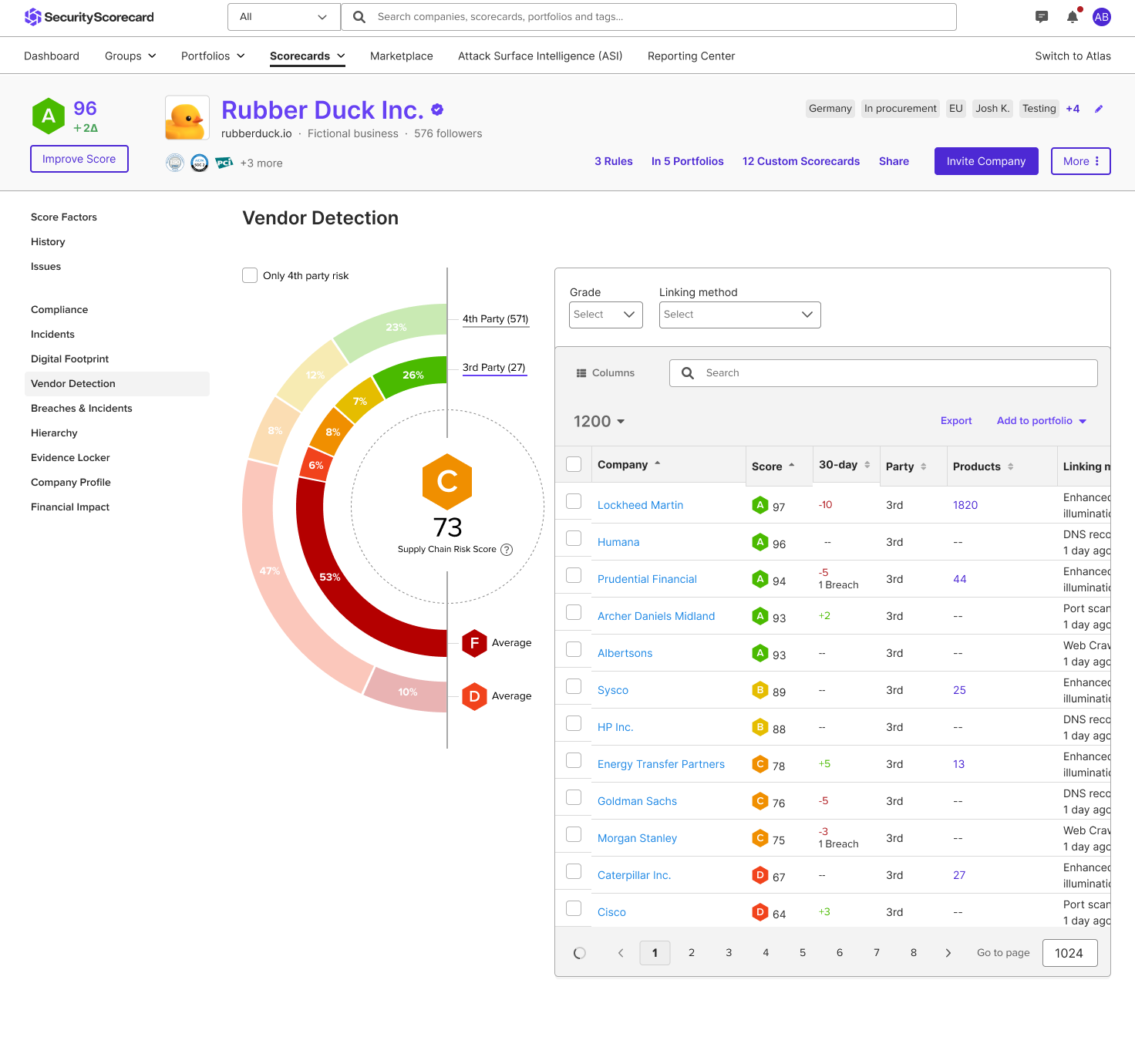

Gain a full picture of any insured’s security posture to supplement application data

AI-powered workflows

Claims-correlated data prioritizes areas of focus, enables automation, and drives action

Continuous monitoring

Real-time data keeps you informed of new issues that could impact portfolio performance

Policyholder alerting

Stay engaged with insureds using timely communications that facilitate risk reduction

Hear From Our Customers

“We are thrilled to work alongside SecurityScorecard, which is well known in the cyber risk industry for its commitment to transparency, driving value and helping to reduce risk.”

Great American Insurance Company Ryan FitzSimmons, Divisional Vice President1 / 0

“Our goals have been achieved. SecurityScorecard provides a solid foundation for engaging with our customers.”

Senior Product Manager, Fubon Insurance1 / 0

“By partnering with SecurityScorecard we can offer clients valuable insights and analysis before a breach occur.”

Global Risk Solutions Chief Underwriting Officer, Liberty Mutual David Perez1 / 0

“Security ratings give you a dynamic point in time view of cybersecurity posture.”

Senior Underwriter, RSUI Nimisha Aneja1 / 0