How financial services companies protect sensitive client and business information

Streamline your cybersecurity efforts and protect your financial services business from supply chain attacks. Enhance your cybersecurity resilience by eliminating vulnerabilities and fortifying your attack surface.

Financial services companies eliminate threats and stay ahead of attackers with SecurityScorecard

Financial services companies have a vast amount of confidential client and business data stored in their systems and portfolios, which makes them attractive targets for hackers. By utilizing SecurityScorecard, financial services companies gain the context and insights needed to proactively address potential breaches arising from vendors or business partners, while maintaining their reputation and trust with their clients.

-

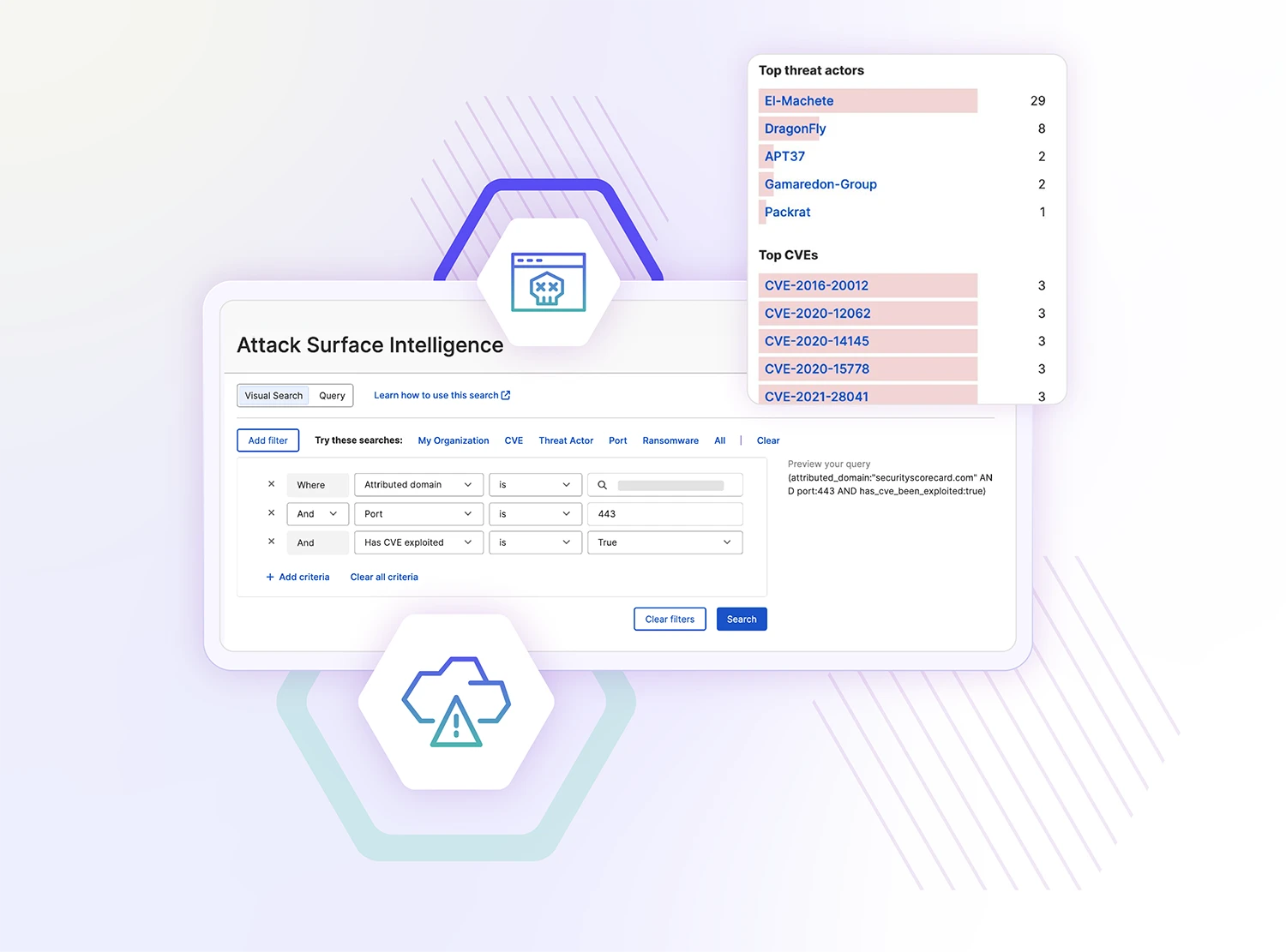

Protect your attack surface

Gain insights into specific risk issues impacting your security rating and prioritize mitigation strategies to enhance your cybersecurity posture. SecurityScorecard provides tailored remediation plans, empowering you to take informed steps towards achieving your security goals.

-

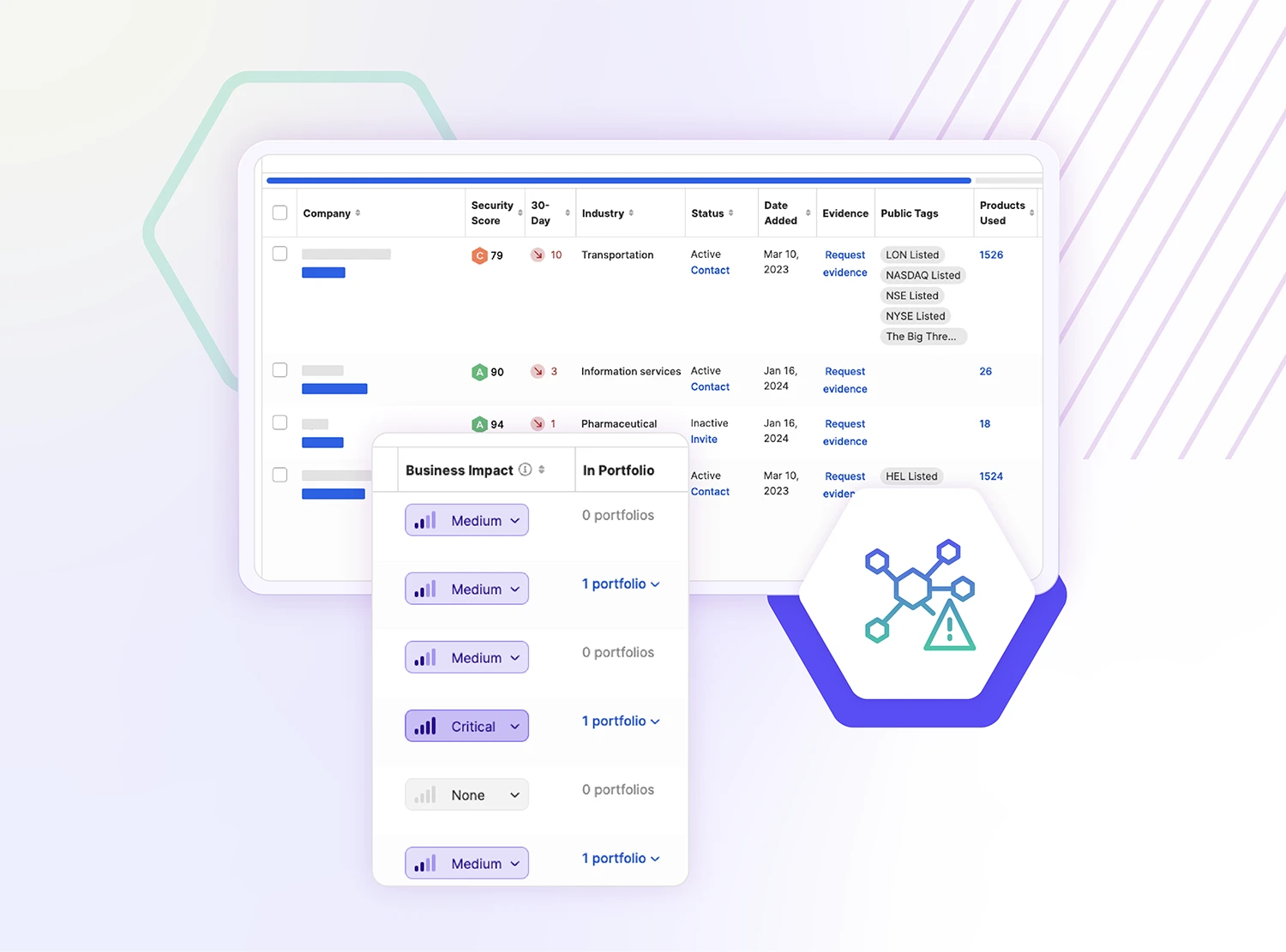

Uncover risks in your vendor ecosystem

Discover potential vulnerabilities within your third-party network. Trusted by over 3,000 customers, SecurityScorecard helps uncover and address cybersecurity issues across your financial supply chain.

-

Visualize cyber risks

Uncover the unknown. Reveal the supply chain of your third parties to identify risks across your fourth parties and beyond. Swiftly visualize links to suppliers posing high risks and uncover previously unknown vendors directly connected to you.

Hear from our customers

-

“SecurityScorecard gives us a more objective and dynamic evaluation. We can now review vendors continuously and present results and key risk indicators monthly to Senior Management and our IT Risk Management Committee.”

Cadence Bank Director of Technology Risk and Compliance1 / 0

-

"My team really likes to use the SecurityScorecard tool to monitor our internal portfolio of companies. SecurityScorecard is like an early warning system for us that shows us where things are starting to go bad, or where my team should go focus our efforts."

Christopher Smedberg Private Equity CompanyMore1 / 0

-

"With SecurityScorecard, 85% of the hard work is already done. Then I can have my team handle the specialized 15%, so I'm saving money for the company and time for my team. I'm focusing my efforts where they are most needed."

Information Security Manager Global Payments Fintech ProviderRead More1 / 0

-

“I can base all my assessments off the security ratings because they’re very accurate. I have no part to play in assessing what score they should be. I trust SecurityScorecard to do it properly.”

Kenneth Ord Head of IT Security, ModulrRead More1 / 0

-

"Having a centralized, quantitative, and timely source of third-party security risk information gives us the ability to present a balanced and accurate picture of third-party risk.”

Al Berg Chief Security and Risk Officer, LiquidNetRead More1 / 0