Cyber Risk Quantification for Financial Risk Reduction

Knowing the likelihood, frequency, and severity of cyber risk lets businesses assess their risk profile and determine the potential impact on operations. By translating these risks into financial terms, organizations can determine their financial exposure to cyber threats and make well-informed decisions on allocating resources. This boosts security posture and helps communicate risk in business terms. It also fosters collaboration among security professionals, business leaders, and stakeholders.

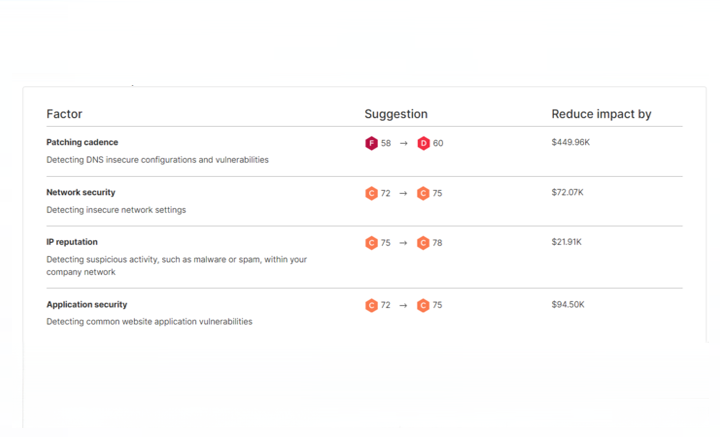

Prioritize cyber risk management decisions based on financial impact

Cyber risk is not just a security issue; it’s a business issue. When security and business leaders don’t agree, it causes problems. They misallocate resources, fail to meet expectations or leave the business unprepared for threats. Effective collaboration between security teams and business leaders is critical for aligning cybersecurity efforts with overall business goals.

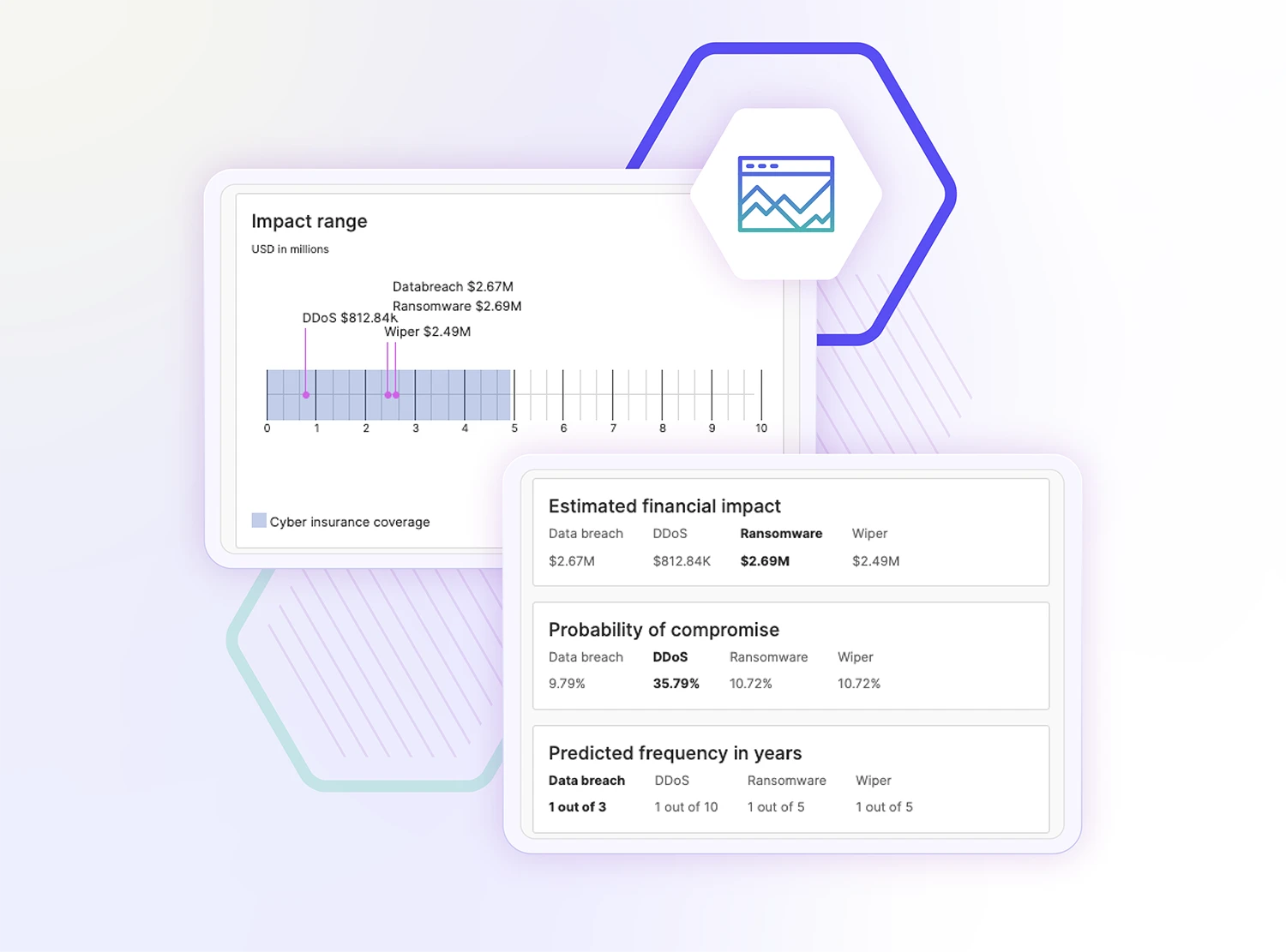

By quantifying cyber risks in financial terms, organizations can better understand the potential monetary impact of threats. This helps them focus their remediation efforts on what aligns with their risk appetite and business goals. SecurityScorecard’s CRQ tool lets risk management professionals measure the financial impact of cyber risks, helping them work with business stakeholders and achieve better outcomes.

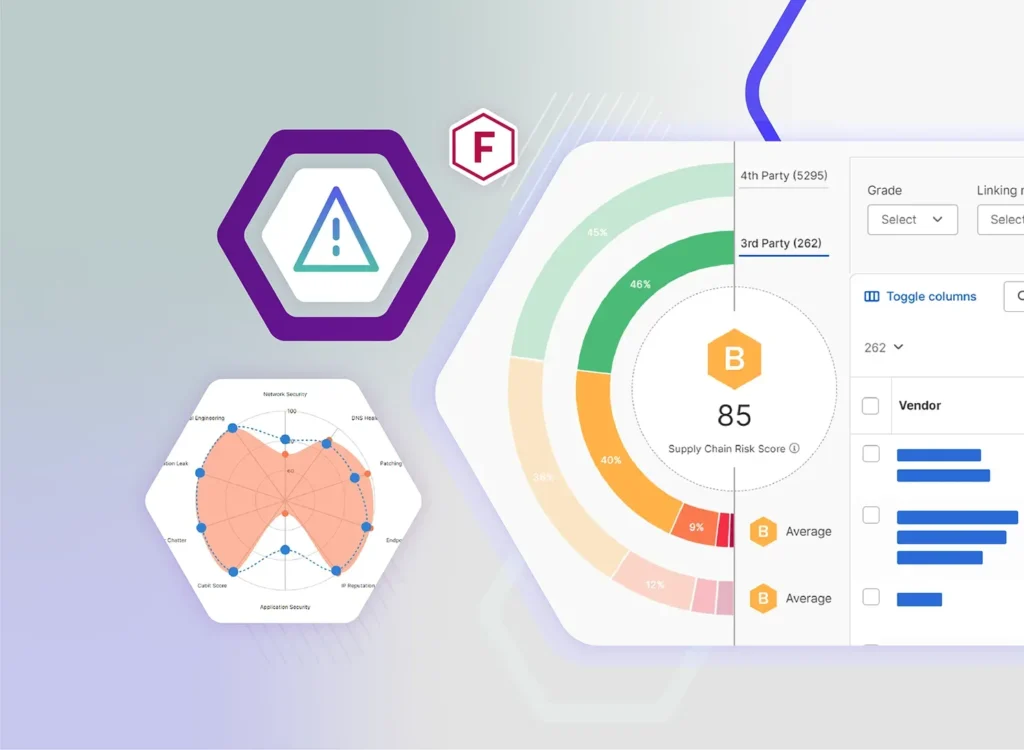

A View Inside

Implement actionable and scalable cyber risk quantification. Focus on high-priority cyber threats, apply the right security controls, and adjust your strategies as the business changes.

Implement actionable and scalable cyber risk quantification

- Limit your exposure: Direct cybersecurity investments toward the most likely or damaging loss scenarios. By targeting the risks that have the highest potential impact, businesses can reduce their overall cyber risk exposure. Monitoring and improving CRQ metrics ensures that security controls remain aligned with evolving cyber threats. This minimizes operational risk and potential financial losses.

- Put dollars to work to generate ROI: Direct capital toward the security enhancements that align with your business goals and desired financial outcomes. By measuring the potential impact of different risks, organizations can better allocate resources to areas where investments will generate the highest return and reduce financial exposure.

- Improve collaboration and communication: Translate complex technical risks into clear financial terms to simplify how peers and partners discuss and communicate cyber risk. Risk management frameworks that present risks in monetary terms and use common language can help security professionals. This will foster better collaboration and align security programs with broader business goals, improving decision-making and strengthening the organization’s cybersecurity posture.

Critical Capabilities

-

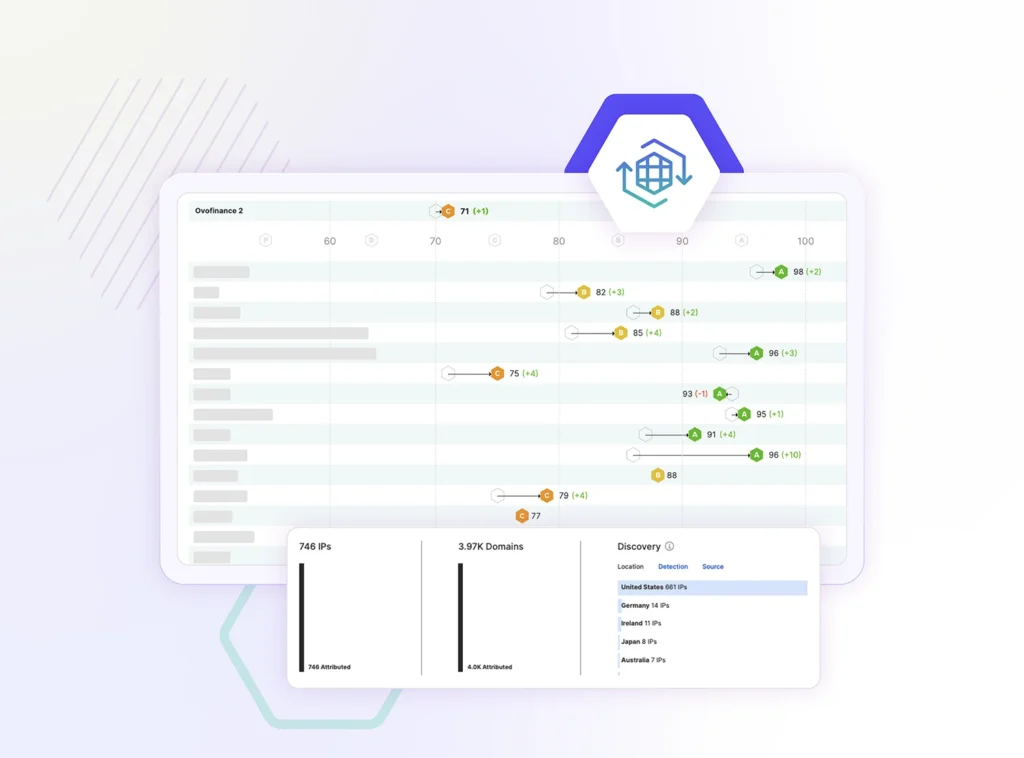

Security posture informed

Go beyond industry average analysis and gain actionable insights into your company’s unique risk profile. Use advanced cyber risk assessments and industry frameworks to identify the vulnerabilities and threats most likely to affect your organization

-

MITRE framework mapping

Incorporate an assessment of defensive configurations against different threat actor strategies. Based on the tactics, techniques, and procedures often used by adversaries, find gaps in your security posture and improve your response to cyber threats

-

Ready-to-go model

Skip costly integrations or time-consuming model calibration and instantly get analysis output. Quickly assess vulnerabilities and prioritize remediation efforts. Make well-informed decisions that align with the company’s financial goals and risk tolerance

Explore More

There is much more to the SecurityScorecard platform

FAQs

What is Cyber Risk Quantification?

Cyber Risk Quantification translates cybersecurity risks into financial terms, helping organizations understand the potential financial impact of threats on their business and make informed decisions. By assessing cyber risks in monetary terms, businesses can prioritize security investments based on the potential financial losses from specific threats.

Why is Cyber Risk Quantification important?

Cyber Risk Quantification tools help organizations align risk tolerance with their cybersecurity strategy, prioritize fixes, and use resources to cut financial losses. By translating cyber risks into financial terms, organizations can make well-informed decisions on where to focus their security investments. This ensures that resources focus on the most impactful cyber threats.

How do you calculate cybersecurity risk?

Cybersecurity risk is calculated by evaluating the likelihood of a threat exploiting a vulnerability and the potential impact on an organization. This involves assessing technical vulnerabilities, threat intelligence, and business-critical assets. The results are often quantified into actionable scores or financial terms to help prioritize mitigation efforts and guide decisions.

How does Cyber Risk Quantification help with material risks?

By assessing potential impact and financial losses, CRQ allows companies to measure and manage risks, supporting strategic investments and proactive risk management. This enables organizations to prioritize cybersecurity risks based on their financial exposure, ensuring that cyber risk quantification efforts align with risk tolerance and business goals, ultimately protecting against costly cyber events and minimizing the potential for long-term financial losses.

How does Cyber Risk Quantification support remediation efforts?

CRQ helps organizations prioritize vulnerabilities and allocate resources. It does this by quantifying the potential impact of cybersecurity risks, which ensures a focused approach to mitigation. Translating these risks into financial terms helps organizations make data-driven decisions on which vulnerabilities to fix first. This will optimize their security programs and ensure that remediation efforts reduce the most significant financial exposure and cyber risk.

How does Cyber Risk Quantification improve communication with stakeholders?

CRQ translates technical risks into financial terms. This makes it easier to communicate potential impacts to stakeholders and align security investments with business goals. This approach boosts understanding between security teams and business leaders. CRQ also helps prioritize cybersecurity investments that reduce the highest financial risks. In this way, it aligns security efforts with the company’s goals and risk appetite.